Twenty-eight years ago I perpetrated the worst financial mistake of my entire life so far. I bought a house, in the hugely overvalued market of 1989. It seemed a good time to look back at how this happened, because today the Pru, one of the partners in crime regarding endowment mortgages, tells us that one in four retirees have never recovered from that kind of 1980s style cockup, and are carrying mortgage debt into retirement.Not only that, but three more waves of the the financial instrument of wealth destruction otherwise known as the interest-only residential mortgage will be crashing on the battered shores of British residential mortgagees in the next 15 years. I was only the advance guard.

Very few people are rich enough to have saved enough money to be able to service big existential debts like a mortgage in retirement, so the financial whizz-kids seem to be selling these guys equity release plans to fix the failure of their younger selves to live within their means by eschewing one or more of holidays, kids, pets or general consumerism. I recently came across the documentation for that piece of feckless financial foolishness, so I thought I’d deconstruct it here. Obviously Brits have learned in the intervening three decades, so our housing market is not at sky-high earnings multiples with people signing away a quarter of their gross earnings nowadays. Or maybe not…

You don’t have much control over when you come of an age when you need to find somewhere to set up house, most of the choices in that respect were taken by your parents and determined by the human life-cycle set by Nature. There’s a window somewhere between 25 and 35 when you need to tackle this issue. Your experience of housing will depend on what phase of the market cycle housing is in, plus some wider long-term societal changes, many of which are adverse. Cycles in the housing market a long – 10 years is not enough to see a whole cycle. I was a single man competing with an increasing number of dual income households because women were entering the workforce in larger numbers. I had already been driven out of the city of my birth by rising house prices and I really really wanted to buy a house, so much that I ignored alarm bells, massive factory sirens, red lights set at danger and just about every other indication that I was paying way too much. All I could afford was a two up two down where most of my colleagues from previous years were able to buy a semi on a typical graduate salary at The Firm. This even shows now – as an old git I am thinking of moving upmarket rather than down, because my hatred of the property asset class ran so deep that I never moved from the semi I bought a decade later.

feckless financial foolishness deconstructed:

Buying a house at that time was bad enough, but I compounded my mistake by choosing an endowment mortgage, because I was a foolish and greedy 28-year old. My parents had said the only way to buy a house was with a repayment mortgage, and made a decent case of as to why. So I listened to the sales patter of how a endowment could make even more than the capital, all tax-free, and the pound signs lit up in my eyes and in about half an hour I doubled down on the error of overpaying, signing up to this promise

So putting my 28 year older and wiser head on my 28 year old body, let’s take a look at what is wrong with this. If the promise had held good I would have paid 25 × 644.52 = £16113 to get £41500 in 25 year’s time. Which is a fantastic deal, what’s not to like? Ker-ching. Oh and my mortgage gets paid off if I die early. To be honest that’s not my problem, I suppose I should have made a will, because that was never going to benefit me – strike one. What I heard in the sales patter was a very good chance of doubling the money. What the dimwitted 28-year old failed to take into account is that I damn well should expect to double my money in 25 years time – at the time half the value of money died through inflation every 10 years, so in 25 years that profit would be worth diddly squat. I was clearly not reading the documentation right, because it only offered an extra 15k using the most racy projections, sustaining an investment return of over 10% p.a. for twenty-five years straight. Easy peasy.It’s the selective focus bias – you see what you want to see.

To get this putative win, I had to take an investment product described in the vaguest terms I have ever seen – never mind active or passive management, there was no idea of fees or anything else, it boils down to a statement of – we will give it a go, but nothing is guaranteed, sunshine.

There is no transparency whatsoever, but hey, the salesforce can say anything to big this up. If this offer came across my desk nowadays, the second word would be “off”. At least I can say I made some use of the intervening three decades to get a little bit wiser.

So what happened? Let’s take a look at the state of play after fifteen years had rolled by, that’s half a working life in my case

Well, the good news is that I get about £5000 more than I’d have paid in at the minimum guaranteed sum. The bad news is that even with a total return after fees of 8% p.a. sustained for ten years I’d have been £11k short1. Now in 2004 £11k looked like a lot of money to me, and I was pretty damn sure that I didn’t want to eat this loss.

It seems that unlike 25% of my fellow endowment suckers I took action during the term of my mortgage to pay the bugger down, and eventually I kicked up enough fuss that Friends Provident paid me off with a bung in 2005, which I also used to make a capital repayment. Then as my career began to flame out and crash and burn in 2009 I started paying down more and more of the capital, adopting a financial brace position against no longer having an income. That’s actually a really dumb thing to do for people who are trying to retire earlier than 55, but fearful people make bad decisions sometimes, and that was mine. It meant I was poorer in the last few years, but I will be richer from about now – the mortgage could have smoothed my cashflow between retiring from work and getting to 55.

Look at those mad assumptions

Even in 2005 they were talking about investment returns of 8% a year. That just ain’t gonna happen on a sustained basis, and the lowest assumption of 7% way back in 1989 turned out to be total codswallop. That was the risk-averse cautious assumption – it’s bloody nuts. This was massive sample bias due to inflation – after all, just ten years before I signed up inflation in the UK was running at over 15%. You know what the man from the FCA says

Past performance is no guide to the future

Well yeah, but WTF else are you going to go on – Tarot cards or reading tea leaves? Mystic Meg? Inherent in the very fact of stock market investing is the nasty little assumption that you can qualify what you will get in the long run informed by what happened in the past[ref]this dirty little secret is inherent in the SWR and things like firecalc are doing nothing other than informing you from past performance[/ref]. Nevertheless, the 28-year old me could have avoided all those mad assumptions by doing the sensible thing and getting a repayment mortgage. Epic fail in market timing and choice of repayment method.

Winter is coming…

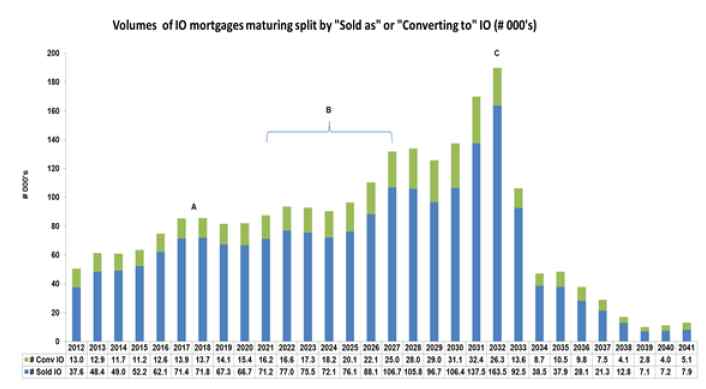

What’s really bananas is that people didn’t learn from the endowment mortgage debacle. Look at this chart from this FCA confidential2 report published on the open web

Wages are stagnating, though I guess the high Brexit-induced inflation has reduced all these guys capital debts by 20%. Let’s hope their wages keep up with inflation, eh, because otherwise Winter is coming, and it will be served up with a good amount of Discontent. Their pain will be worse too, because at least I had a deficient repayment method that would have paid about half of the capital. Since then interest only mortgages were written without any requirement to have a method of repaying the capital at the end, so these big cohorts are coming to the end of their 25 year extended home rental term aka interest only mortgage, and the requirement to actually buy the house will come as a bit of a surprise by the looks of it. Okay, so they have taken a call option on the price 25 years ago, but they’ll still need to whistle up the price or move out.

- I am being slightly disingenuous here, because Friends Provident demutualised in 2001 and I got about £7k in shares which I sold immediately, and used to make a capital repayment, which I guess brought the outstanding amount to about £34k. ↩

- I downloaded it on 17/2/2017 from https://www.fca.org.uk/publication/research/fca-interest-only-mortgage-review.pdf and it’s still there in June 2023 when there’s a renewed mortgage seethe going on ↩

Funny how experiences can differ so much with the same situation – but was it possible for anyone to win too, somehow, with endowment mortgages?

My parents bought in ’89 just after the crash & were happy because they wouldn’t have otherwise been able to afford at all – the catch was that they worked themselves almost to death paying off the 17% interest rate. They still have health problems today from working so hard & I find it hard to see that it was a good deal for them, albeit the only one they were able to get.

Interestingly, when I bought a car back in 2006, the besuited snake in the showroom sat us down & dazzled us with his calculations sketch of a magic trick that let you initially put down very little, make monthly payments for ever & essentially bet it retained serious value after afew years. So I said that this looked to me as the same principle behind endowment mortgages; we want to pay upfront …..he looked like a bulldog licking piss off a thistle.

LikeLike

> bought in ’89 just after the crash

I think that’s what they did right that I did wrong – I bought in February, and the crash happened over the summer for foreseeable reasons it still pains me to recall I ignored 😉

I must remember that bulldog next time I have some berk trying to pump up his bonus at my expense!

LikeLike

Here in CH endowment mortgages are virtually unheard of.

But in almost all cases 66% of the value of a house is covered with an interest-only mortgage. Forever…

And these days new flats in the Zürich area are doing £1M, with houses easily double that. All hell will break loose when interests rise again…

Luckily I bought much cheaper in ’97, in the wake of a small housing recession, and very unswiss proceded to pay off the mortgage in full. Recently moved to a significantly cheaper place in the countryside and now the rental income from my previous house is the basis of my early retirement.

Worked better for me than my pathetic attempts at investing, but yes, it remains a cluster risk to rely on a single incoming rent.

LikeLike

> But in almost all cases 66% of the value of a house is covered with an interest-only mortgage. Forever…

Wow – that is remarkable. And not quite what I would have thought of the Swiss national character!

Mind you, it’s an outstanding wheeze for increasing house prices. I wonder how long it’ll take to catch on in Blighty. That is lateral thinking in a big way.

I’d heard of intergenerational mortgages in Japan, but it seems Sweden is also in on the game. Definitely the way forward 😉

LikeLike

Bought on an interest-only/endowment basis in ’99, just before I started reading every Sunday in the financial pages about a mis-selling scandal!. When I moved five years later, I cashed in the endowment getting back a little less than I’d paid. My next property was also bought interest-only, and still is. Thankfully I’ve made my own arrangements for repaying the capital. I’m sure many others in the chart you showed will be in the same boat, so things might not be quite as bad as they seem.

LikeLike

It’s a fair point that not all IO mortgages will be a problem and certainly the earlier cohort had a lot in the Accumulated Wealth and the Platinum Pensions groupings in the report, thus the means to resolve the problem. The later waves, however, will have had poorer pension provision and higher income multiples. I think the quarter of people carrying mortgage debt as they retire shows it’s an issue for a fair few people.

LikeLike

There is always a large retail financial scam going on

Question is, what is today’s?

My money is equally divided between:

– equity crowdfunding

– property crowdfunding

– p2p lending

LikeLike

Dude, the big developers are selling houses now on entire sites as leasehold – but the leaseholds are actually sold to a separate [loansharking] company who can then jack up the annual take astronomically before the ‘owner’ even tries to buy it themselves if they spot the small print. The properties in question might as well have subsidence or japanese knotweed because nobody’s going to buy off you if they don’t know what the amount of ‘protection money’ they’ll be squeezed for every year will be. The beauty of all these things in the UK is that they’re absolutely legal/100% f’ken A OK.

Cars on PCPs are just glorified hire purchase baubles – basically everyone is ratcheting up the leverage of their finances/lives to the point where if you suddenly lose your job, (never more likely in these times of austeritah) then everything falls apart, transport, home, communications …..the plug is pulled on your entire life, you’re off the matrix. With equity crowdfunding, I suspect you’re right, a lot of people probably don’t get that the probability of a startup succeeding is like being struck by lightning, but in a nice way.

With P2P in general, if they don’t know it’s not a savings account, but an investment, then they deliberately didn’t read all the warnings …..I keep my allocation here small & regard it as an investment style rather than an asset class. Investing in small businesses [for example] is a totally different kettle of fish to luxury goods which are basically being pawned because the owners got caught short with liquidity. So the smart play is to only get into what you really understand – but if your point is that punters shouldn’t be allowed to get out of their depth, I have some sympathy with that. The innocent are screwed anyway though, what with the lobbying power of the various rapacious industries – look at day trading being tax free because they aren’t classified as gambling, or FOBT machines being allowed to ruin a generation as badly as any other addictive drug. In our contemporary society, even if you have an average IQ or a bad run of luck & no backup, there’s no mercy ….welcome back the nasty party, feel the burn.

LikeLike

I wonder how long the leasehold scam can work as its already getting put around the broadsheets. I’d imagine people would wise up to it pretty quickly.

LikeLike

@Neverland – I like your thinking, there is always a scam abound – I’d say out of those 3 its got to be P2P as the 1st two are really obviously high risk. The bigger P2P outfits are starting to look respectable and safe, so sods law it turns out to be a scam..

LikeLike

Neverland’s Law of Conservation of Financial Scammmery – it cannot be destroyed, merely transformed. I like it!

LikeLike

Timing & circumstances are so critical to the “success” or otherwise of buying a house, especially if borrowing money over a long period of time – which is how most of us have to do it.

I bought IO in 2001 and by overpaying into an investment ISA ended up owning outright in 12.5 years. The key factor in that though was dumb luck – I took a 5 year tracker deal just before the crash of 2007 & over the next few months my interest payments dropped to all of £25/month – which made overpaying ever so easy. It could easily have been different.

LikeLike

I bought a £30 endowment in Nov 1990. It promised payback at 7.2% growth and paid back £21k, 70%, in the end. My worst financial decision ever, but I carried on paying in long after I’d paid off the capital, because I couldn’t face the stress of closing it down and accepting my mistake. I couldn’t claim I was miss-sold, because in all honesty I knew the risks, and in 1990 inflation was 9.5%, so the return sounded likely. What I didn’t realise then was the outrageous fees charged for endowments. Of course the flat, then house I switched to repayment terms 7 years later completely made up the loss with rampant price rises, and when I was finally shot of it, £9k was such a small part of my portfolio I didn’t worry.

The inflation collapse from 1990 (http://inflation.stephenmorley.org/) indicates as much as anything why the predicted returns were so far off.

My mortgage bought 41% of a 2 bed London flat, its payout 25 years later would have bought 6% of the same flat.

LikeLike

Carrying on paying in was probably a more rational response than getting wound up about it as I did, though I did successfully push a mis-selling complaint on the grounds a single man with no dependants had no need of life insurance. You probably got more numerically than the cash you put in, although it’s tough to work out the higher real value of the early contributions.

The investment was definitely a pig in a poke though – zero transparency.

LikeLike

BTW, I bought 2/3 the way down the house price crash then. I paid £70k for a flat advertised at £77k, and I have vague memories it was a lot more before. So timing the market made much more difference than picking the right mortgage.

LikeLike

That’s the real tragedy with housing – you enter the market at a time determined pretty much at birth, with a leeway for a few years. It’s something that if you have to put on hold for half a market cycle can really delay important life stages. So it’s a tough one to market time.

LikeLike

We swapped our repayment mortgage into a flexible interest-only mortgage when the Building Society started offering one. We also extended the mortgage term. It worked out well. When we were flush we paid the loan down a bit; when we wanted to make a use-it-or-lose-it investment (e.g. a pension contribution) we increased the loan. When we retired we used pension lump sums to clear it off.

I wasn’t knowledgeable about finance until long after the big financial decisions of our lives had been made. In effect they boiled down to two. (i) Sign up for final salary pensions. (ii) Don’t muddle together house purchase with investment in stocks and shares. One risk at a time, eh?

On timing we can give much credit to luck. A family member was unlucky and lost all his capital in the house price collapse of which you complain.

Oh, there was a third rule. For as long as possible avoid cars, ride motorbikes. When you do buy a car let it either be a banger worth tuppence, or a young second hand car that you hope to keep for fifteen years.

LikeLike

> I wasn’t knowledgeable about finance until long after the big financial decisions of our lives had been made.

Ain’t that the devil with the whole topic 😉 You only start to get interested in fightingthe fire when it has raged through your finances. On the whole I survived OK, but the sheer numbskullness of my late-20’s self is staggering, and it is only due to your (i) that it came good in the end.

With you on cars. Maybe not on motorbikes, but each to their own!

LikeLike

@Ermine, out of curiosity, have you compared how things might have panned out if you hadn’t bought in ’89 and instead rented for that period of ownership?

LikeLike

Yup – the gory details are in this post. It really was a terrible move. In combined equity and saved rental payouts I broke even 12 years later relative to what renting would have been, the 12 years had two recessions where had I lost my job I would have been wiped out by the negative equity.

LikeLike

@ermine I bought about the same time as you, just before the market collapsed. Funny thing is I wasn’t that bothered about owning but my parents pushed me into it, that was the last time I took their advice.

LikeLike

II bought a flat in 1983 inEastbourne, it cost £21000. I was going to rent instead because I thought house prices had risen so much over the previous decade there was no way they could continue rising so much. My boss said I was mad because Britain is built on appreciating house prices.

I sold the flat two in 1985 for £28000 and bought a new semi in Battle for £41000.

Sold that in 1988 for £68000 and bought a detached for £98500 near Lewes

Sold that in 2004 for £275000, bought a bigger detached for £435000 near Aylesbury, just had it valued at £675000.

Housing market works for me!

LikeLike

So you’ve paid £224,500 (£21,000 initially, the £13,000 difference to move from Eastbourne to Battle, the £30,500 difference to move from Battle to Lewes and the £160,000 difference to move from Lewes to Aylesbury), plus mortgage interest, maintenance/improvements costs and transaction taxes/costs along the way, to now own a property worth £675,000. So far so good.

The above amounts to an underlying return of about 5.5% per annum (not bad, but nothing to get too excited about). That’s before the above costs and before inflation which will hurt your real return, but also before factoring in leverage, which will help as you didn’t pay everything upfront.

However, imagine instead that house prices had stayed flat (across all regions), so an annualised return of 0%. Even before factoring in lower mortgage interest and transaction taxes/costs (given these are linked to prices), you’d have paid around £154,000 less (around £70,500 instead of £224,500) to get to live in the same houses. So has the housing market really worked for you?!

If you stay in your current home, the housing market has just tied up much more of your money and wealth in inaccessible bricks and mortar. If you downsize, you need to release a lot more than £154,000 of equity to come out ahead, factoring in the extra costs, inflation over the years and that’d you’d probably rather have had all that extra money to do with as you pleased when you were younger (whether to spend or invest).

(P.S. This comment in not directed at you personally in any way, it’s just the numbers lend themselves to a case in point about the desirability of a rising housing market for those for whom a property is a home first and an investment second, if at all)

LikeLike

The flat I bought in 1983 had an endowment mortgage, supposed to pay out £20000 to cover the mortgage, actually paid out £28000 in 2008

Took out another endowment for an extension to the house one at Lewes in 1996 for £20000. It paid out £13000 in 2013.

Timing is everything.

LikeLike

> Timing is everything.

Can’t argue with that, it applies to other markets too, I guess I got the win on the stock market starting 2009.

The trouble with an endowment is you take a massive investment risk early on in your working life, and by the time you know if it worked you are at the end of your working life. It’s fine if the risk worked out, but 25% of people with IO/endowments retiring carrying mortgage debt seems to indicate the risks are high – after all some people like me were hit but took other steps to fix it, so the bomb rate is worse

LikeLike

Took out an endowment for £25000 in 1983. Paid out £20000 in £2008. Made a claim for mis selling to the Halifax sometime in the early 2000s. Not because it was mis sold but because there was a shortfall. To my surprise they offered me a settlement of £3500 over the phone without any investigation because they could not find the original documents.

LikeLike

I took and endowment out back in 1993 via an IFA. I didn’t realise that my first year’s payments of about two grand went straight to him. That’s a serious dent to cover from the outset, and when my policy matures next year it will return just over two thirds of what it was supposed to. The only upside to the tale is that the experience encouraged me to get a grip on my finances and manage my own money going forward.

LikeLike

Dodged a bullet in 1989 myself. We were living in a paid off place by then and planned to move up and remortgage. The market was really rocking in Canada back then. My father-in–law advised against it but what did he know?

The deal was quashed because the land zoning approval fell through. Shortly after that the market crashed and it would have taken until 2004 to recover. We just lived in our old place through a series of illnesses that may have forced me to retire with a mortgage had things gone the way we planned. We saved like mad and did eventually retire early – no mortgage.

What we would have bought was probably too much house to retire in anyway – and not designed for old folks.

We didn’t have those endowment type or interest only mortgages back then fortunately. Repayment types only.

LikeLike

The most frustrating thing is ignorant people – most relatives over a certain age in my life – looking at me as if i were slow & repeating ad nauseam ….”You can never go wrong with property dear!”

To be fair, it’s what they saw work all their lives, so to them it’s as natural as explaining an obvious fact like gravity to a child, even if their own grasp of finance is just being able to count. You can explain that timing is key, buy-to-let has been rumbled, the current low interest rates aren’t a blessing if your mortgage rate doubles with the slightest shift in % increase…..

They will tell you that they don’t really understand all that sh*t, but what they do know is that in the uk at least, no govt. will get in that doesn’t rig the system to keep house prices rising. (so what if it’s at the expense of half the population having precarious access to accommodation) Most infuriating, is that it always works out that they’re right, given enough time – much like the stock market can & will crash on average once a decade, but over time gradually the trend line is always appreciating. As an ordinary individual then without substantial savings the best I can think of to do, is invest in property indirectly – to hedge against losing out on the opportunity [whilst at the same time not putting all my eggs in one basket] – via a property fund.

LikeLike

Similarly to Fabian I took on an endowment policy to fund an interest only mortgage of 18K on a flat in Cheltenham in 1983 and not only benefited from MIRAS but also tax relief on the life insurance of the endowment policy. Kept hold of it through subsequent house purchases and the endowment scandals and it paid out 25K on maturity in 2008.

Shows how tax policies can influence decision making at the time….plus it did seem like a good deal to a naive 23 year old in his first home owning experience

Never too sure what impact these had in toto but I did end up paying off my mortgage on subsequent homes years early through over-payment when interest rates were low and through the the endowment paying out – plus, like Fabian, I had benefited from selling shares in the mutuals which had gone private over times (remember Friendly Societies?).

I guess investing 25 quid a month in an income IT in a PEP/ISA would have done far better and have been more transparent around costs and benefits – something I came to appreciate in later life.

LikeLike

It is possible that the canning of MIRAS also adversely changed the arithmetic for me – it was the limiting of MIRAS to 30k (not 2x30k for a couple) in 1989 that cause the bubble.

Certainly colleagues who had bought with an endowment mortgage earlier than me, say early to mid 1980s had a similar experience to yours of having it meet the payment of the principal at the end of the mortgage.

And having anything run in parallel to repay at the end was a rarity in the 2000 to 2007 period of IO mortgage when they were brazenly used to reduce the monthly repayments so people could jack up the prices they paid. These are the later two waves that have yet to mature…

LikeLike

I made my last “investment” in real estate in 1979 – at least that we paid for out of our income. It was $75,000 Canadian and today is still stuck in my house and worth approx $400,000. That is a 38 year average return of 4.5 % – and after 3% inflation over that time it isn’t much more than you’d get in a bank term deposit. And just as illiquid I might add.

I suppose if you factor in imputed rent and deduct taxes and maintenance the picture is a bit better – but is it really the gold mine that everyone seems to think it is?

We could never depend on our real estate to finance our retirement. That is what pensions and financial assets are for. Most folks I know who just have their house are poor as church mice unless they sell.

LikeLike

I think you really do need to add in the imputed rent to the benefit you’ve received from that house. You’d have had to pay that to a landlord over the years otherwise – it’s tough to shelter under your bank term deposit in the rain for four decades, particularly in the Canadian winters 😉 This probably improves the return no end.

LikeLike

I had an endowment with my first mortgage in 1992, mainly because it made the overall monthly payment affordable. The actual mortgage on the house I now own has been repayment for ages, but I did keep up the payments, just over £100 per month which I could easily afford. It has now matured, with a payout that reflects a net return about 4.25% pa in numerical terms. Of course I could have done better investing elsewhere over that period. However I don’t think i would have put that cash away so consistently and not ended up spending it, so actually it has worked out ok for me- particularly as the timing coincided with the loss of my job. I did at one point consider making a misselling claim, but thought it would be dishonest as I did understand at the time what I was being sold…

100% agree that the coming IO scandal for people who had no investment vehicle will be much worse!

LikeLike

I am amazed that such a late endowment policy paid out and the numerical return is quite good. You have done quite well, because inflation averaged 2.7% p.a. over that period, so congratulations! It’s the first time I’ve heard of a post 1989 policy coming good.

LikeLike

Alas, Survivor – what makes housing so profitable is the leverage, not the asset class. A property fund as a hedge is no bad idea (as a part of a portfolio) but it’s no replacement for that risky multiples-of-salary-loan-to-invest.

LikeLike

It’s a pity there isn’t CGT on res property, although they should discount inflation perhaps. There are few res property funds – I was in Castle Trust which was genuinely a property index fund, because I wanted my slice of Help to Buy without buying a house. But it’s no longer a proxy for res property. You can spreadbet the housing index, but the cost of carry is very high, though the leverage could possibly help people saving for a deposit. I only know of Hearthstone and sort of Grainger as residential housing equity exposure. And the builders I guess. REITs are generally commercial property, which is a very different asset class, because it doesn’t have the gov throwing sweeteners into it to keep prices high.

LikeLike

I think I am about to do something really stupid. We are close to exchanging on a property but not selling our own until afterwards as it needs some work, new bathrooms, kitchen, paint etc to take it from the early 90’s to now, apparently spending 30K will add 90K. I can deal with the extra 3% stamp duty as that is just cash flow which I can manage. But what worries me is the risk that in say the 6 months before I sell we could well be in the midst of a significant downturn, or maybe not. It all hinges on interest rates I suppose, even a tiny rise will cause the whole house of cards to collapse. It seems to me that house prices are softening but maybe that is my imagination.

LikeLike

The reisk is not so bad for someone who already has a fair amount of equity in the asset class. I guess you can eat a 60k loss and break even, though it depends on how much you are spending on a bridging loan for 6 months – when I last looked the cost was eye-watering so I used a 0% offer on a couple of credit cards for the week I did that.

LikeLike

I am taking out a very substantial IO mortgage at 1.44% for 2 years. That should give me time to sell the first house. I could sell shares to fund property #2 outright but that would generate a large CGT bill. I have already sold enough of my wifes and my own investments to max out CGT efficiently. When the first house is sold I can then pay off the mortgage completely and have a bit over. Then I can finally retire with enough cash to coast to 55. As far as the mortgage company is concerned I plan on working. We discovered that if I retired first then getting a ‘bridging loan’ would have been nigh on impossible. Part of the reason to not sell first is that moving and timing completions is so bloody stressful, but we may yet pay the price for that convenience.

LikeLike

I guess your leverage isn’t too bad then. On your entire estate of two houses you have a mortgage on one, and assuming you are changing up it’s the cheaper one. So the leverage is 50% tops. Plus you have assets to pay down the mortgage, though I guess a housing crash can be associated with a stock market crash. But with such a low rate you can take your time.

As an extended bridging loan and/or a match to the rate-limiting of CGT it’s one of the few correct uses of an IO mortgage, because you don’t need the asset at the end.

LikeLike

@Brendan – you’re right, it is important to emphasize that aspect – I think the demand still has to be restricted to supply or less though, for the formula to work.

Interestingly, I read that in the US, the equivalent is the stock market, [land & house-building costs are too cheap/plentiful to restrict supply easily] so every govt. that gets in has to keep the S&P plate spinning in the air. It was this need for keepy-uppy that coined the phrase the ‘Greenspan put’, as long as the middle-class people’s shares were climbing visibly & they could use that as an ATM to counteract falling real income, then the illusion of prosperity kept rolling.

LikeLike

Bought in the early 90s. As a reader of financial sites I knew I didn’t want an endowment and was very up front about it. The advisor managed to convince me to switch to a 50/50 repayment endowment and I suspect he did very nicely out of it. Managed to remortgage out of it and close the endowment at loss about 8 years later, still bitter about the manipulative way they pushed bad deals on inexperienced folk.

LikeLike

“I think you really do need to add in the imputed rent to the benefit you’ve received from that house. You’d have had to pay that to a landlord over the years”: only part goes to the landlord; for part he is just a conduit passing it on to the taxman. Which is why imputed rent should be taxed. (It was until ’63 when the Conservative govt abolished it.)

“Part of the reason to not sell first is that moving and timing completions is so bloody stressful”: that’s one of the things they order better in Scotland.

“apparently spending 30K will add 90K”: by instinct I tend not to believe such claims.

“It’s a pity there isn’t CGT on res property”: Labour govt to thank for that.

“… although they should discount inflation”: indeed they should; that they don’t is due to a Labour govt.

LikeLike

Imputed rent isn’t all that easy to figure over 38 years but I’d roughly calculate it increased my return on investment from 4.5 to maybe 7 percent per annum. Deducting inflation that’s about a 4% return in 4 decades – sort of like a bond I suppose. Again I don’t see the gravy train that real estate is supposed to be, but I’ve never lived in a place like London or Vancouver or Toronto.

LikeLike

As an IFA, I will be honest and say that I last arranged a “low-cost” endowment in about 1994 (a very small “top-up” policy with what was then Commercial Union for, I think, £9,000), only ever having arranged about 20 or so back in the late 1980s.

The “commission” thing is quite interesting. Back in the day, commissions were set by the LAUTRO regulatory body and, for a short time, there were the same from all 90-odd life assurance companies transacting business in the early 1990s. This was found to be anti-competitive and the so-called “maximum commission agreement” was abolished. The idea was that commissions would fall; they went up of course.

IFAs were generally paid less that “tied agents” as, of course, the latter gave Mickey Mouse Life Co 100% of their business. But, what were the commissions?

Well, on a typical 25-year endowment policy costing, say, £100 per month, and assuming that the commission was “indemnified” (i.e. paid up-front) then the LAUTRO scale stated that 66.23% of the first year’s premium was paid in commission. So that’s about £794.76. This was subject to an “initial period” of, in this example, 38 months. If the policy lapsed within that period a proportionate “commission reclaim” would be made on the adviser. After the initial commission a “renewal commission” of 2.5% of the monthly premium would be paid. So, in this example, the seller would be paid £794.76 up-front, plus a further £655 over the full term of the policy.

When the commissions went up, they were proportionate to the LAUTRO scales and this highest I ever heard of was 160% of the LAUTRO scale. This didn’t alter the 2.5% renewal commission, but did mean, potentially, an up-front payment of £1,271.62, in this example!

But what if a “repayment” mortgage had been selected at outset? What might I have been paid then?

Commission on simple term life insurance (which remains today) was 111.83% on the LAUTRO scale, with an initial period of 48 months. 25 years ago, let’s assume that a “mortgage protection policy” might have cost £25 a month. Here, then, the commission would have been about £335.49 up-front and £157.50 in renewal. Factor in an “commission uplift” of 160% and the figures change to £536.79 up-front and the same in renewal.

I have spent some time over the last 20 years trying to get people to act responsibly by having in place a sensible, affordable, strategy for paying off their debts, mortgage or otherwise, and things can be done. I do meet a worryingly large number of people who will do zero towards this though!

But you can see that, back in the day, a salesman would need to arrange about 3 repayment mortgage to earn as much as one endowment loan.

So there is the commission bias!

LikeLike

That’s a fascinating insight into that, I must admit I had suspected the commission % was much more than that. That’s not so say that kissing goodbye to 3.5% worst case was a Good Thing, but from the dreadful performance I’d suspected the commission was 10% up.

I can see how a 3x commission bias is going to concentrate the mind of the salesforce in a big way!

LikeLike

Here is what I seem to spend an increasing amount of my time nowadays (although I mainly work with pensions); it’s a “real-life” case and, although the numbers are small, the principle works whatever the size of the “interest-only time-bomb” problem.

Single lady, no dependants. Small house in Somerset village. Probably worth something like £150,000. Small mortgage of £27,000 on lender’s SVR, half interest only, half repayment (so some positive action has been taken in the past). Costing her, she says, £400 a month. Unit-linked endowment with Abbey Life (was Hill Samuel) due to pay £38,000 on maturity in 6 years time. Awful thing only has surrender value of £17,000. Premium £43.28 per month. Lady has £2,000 Council Tax arrears (yikes!) and £1,500 on credit cards. So, overall financial liabilities of £30,500 or so. Mortgage outgoings currently £450 or so.

She is about to set up small DB (“final salary”) pension as age 60, and that will pay her a tax-free lump sum of £7,400 and a pension of about £96 per month (gross). Very low income otherwise.

Also has two lots of shares worth about £4,600.

Solution? Cash-in endowment, sell shares and take pension lump sum to raise about £29,000.

Pay off nasty Council Tax arrears and credit cards and most of the mortgage. Ends up owing just £1,500 on mortgage. Change repayment term from 6 years to 12 months. That will cost her £130 a month.

So, from debts of £30,500 to debt-free in a year’s time and massive (to her) cash-flow boost. Now paying about £450 a month in mortgage related costs. That will be reduced to £130. Pension starts, so will end up about £420 a month better off by just moving money she already has around. AND no equity release, thank goodness.

This may all be very simple, but you might be surprised how muddled people get with financial stuff!

As I said this real-life example involves small numbers (but very big to her) but the principle holds fast, whatever the sum.

The really big problem is for those with no financial assets at all, aside from a heavily mortgaged home on an interest-only basis!

Best,

LikeLike

Blimey, she is stitched up by the endowment inflexibility. Something vaguely sticks in the craw about letting 21k (less 3200 premiums to pay) go if it really is worth 38k in 6 years, but I guess she’s in trouble now and can’t borrow the £13500 to carry it another six years. Although I’d have thought she’d be a good risk it the lender takes a first charge over the endowment and the house, the LTV is sod all. So near and yet so far!

LikeLike

But at the time, was 7% pa growth a mad prospect? Endowments were (clearly) widely mis-sold thanks to commission bias etc…. but was the theory so wrong? You had to have a repayment vehicle (unlike in subsequent years of IO and self-cert lending in the New Labour years) and you were spreading your risk between global markets and the UK property market. In the end, I expect the vast majority of people who bought in the late 80s and early 90s have made out like bandits in the property casino – but if UK property had been flat and investment markets steadily gone up (by no means a crazy prospect at the time, surely?) these people were likely still to have done ok.

Contrast with today, where if interest rates do go up substantially (and rising inflation must make that more likely – 15% increase in Surrey council tax anyone?) could current repayment borrowers on SVRs and fixed terms coming to an end find themselves in an ugly mess, and with no inflation hedge, while IO borrowers have a lower monthly commitment and (hopefully) some sort of stockmarket assets that go up in inflationary times? Is anyone yet certain who will have the last laugh in this debate? Or am I missing something?

LikeLike

> In the end, I expect the vast majority of people who bought in the late 80s and early 90s have made out like bandits in the property casino

I bought in the late 1980s. I really, really, honestly, haven’t made out like a bandit on property. After 12 long years the slow increase in equity after the suckout meant I pulled ahead of what I would have paid out in rent.

People who bought in the early 90s probably did, and people who bought in the early to mid 1980s did. The former because they bought in the 1990s recession, the 1980s guys because inflation was on their side.

There’s hurt coming down the pike with housing due to the very high valuations and income multiples now compared to historically. If the IO guys have stockmarket assets, then fine, but most people’s reason for going IO is that the payments are lower, rather than to invest elsewhere, because there seems no requirement to have a method of paying the principal, unlike before the mid-90s.

So yes, the people who self invest to make the principal are getting asset class diversification. The others are getting a tail-end debt. We will see soon enough, when cohorts B and C in that report come to the end of their terms in the next 15 years.

LikeLike

Back in the day, when they were all the rage, I was very tempted to take out a liar loan/IO mortgage, so I could just be my own landlord & pay less rent too. Another advantage being you could then chill out instead of having a chronic level of anxiety that the owner would arbitrarily move you on whenever the whim took him ….. to tweak his portfolio or whatever.

A key driver of the overwhelming desire of Brits to own is the fact that renting reduces you to a second-class citizen for all intents & purposes. That’s as intentionally retained as a part of the financial infrastructure as planning restrictions & the artificially high price of land. I’ve heard claims this would change to give people the basic human right of decent accommodation all my life here, but somehow it never happens. The concept’s like a unicorn, everyone knows what it is but nobody’s seen it. 🙂

LikeLike

>A key driver of the overwhelming desire of Brits to own is the fact that renting reduces you to a second-class citizen for all intents & purposes.

And there’s the thing – the UK private rental market works if you can get all your possessions in a car/small van and don’t mind moving every year or two. For most people that loses it’s appeal after a while.

LikeLike

@Survivor and SpreadsheetMan

I think everyone agrees there is a huge need for security of tenure for people who want longer term rentals. Surely many landlords would like longer term commitments from tenants too – they can’t all want to be able to sell at a moment’s notice. Presumably what stops landlords offering 5 or 10 year tenancy agreements is that a hefty deposit from the tenant is needed, which most people won’t pay. Maybe if the govt’s deposit protection scheme offered an above-inflation rate of interest to the tenant and did not attract tax, it would feel less like ‘dead money’? And the landlord could stick in some cash to the same scheme as a penalty value in case of selling from under the tenant?

LikeLike

@Austrian – note deposit protection scheme doesn’t require you to leave the deposit amount with them if you don’t want to. You can pay an insurance premium to them, keep the deposit yourself, and do whatever you like with it.

LikeLike

@TA – That is a very interesting angle – I am ironically simultaneously a landlord & tenant, [easy in these times of not necessarily being able to live where you work, given the insecurity of work too] so can empathise easily with the seemingly opposite positions.

I fully agree some system giving the assurance to both parties as you suggest, would solve the trust issues fairly simply & elegantly. The state could easily establish an escrow account, [proven by the fact that they already do something similar with the deposit scheme] into which both parties could contribute, with a very decent rate of return, like a govt. bond. This would even benefit wider society as a positive spiral could be created, pension schemes & general investors, both retail & institutional would have a safe asset class to pile into ….especially needed in these low-return times.

It’ll never happen for ideological reasons – as current events show, austerity gives the elite the cover to pillage what is left of the nation’s wealth, which has the by-product of rendering the masses helpless; win-win, so why would you not play that hand if you had it?

LikeLike

Timing is definitely a factor.

When I was at school I did home economics and the one thing learnt there – dont get an endowment mortgage!!!! always use a repayment.

My ex bought a house in the early 90’s (a repossession). It had no boiler, most of the electrics had been stripped out and it was on a stupid card meter for utilities.

He bought with a half&half repayment/endowment mortgage. We managed to get the house sorted and I got a job ( I was a student when he bought so didnt do a shared house purchase) so contributed to the upkeep and helped with the DIY.

We made capital payments and when we moved on we didnt need the endowment to fund the next house purchase. He kept the endowment, it was worth nothing and was a real waste of money. It would have never paid off the original mortgage. We bought the next house as a shared mortgage and paid down the mortgage to pretty much nothing just before we split.

When we split and sold the house, the estate agent happened to be the guy that sold him the endowment in the first place – a right shady character.

We split the sale proceeds and moved on with our lives.

The endowment would be just maturing for him now – wonder what my ex actually ended up with as the maturity value?

I bought my own house with an offset and paid down the mortgage with my job bonuses. I now own the house outright. I dont like debt in whatever form. I lost my great bonus-paying job a few years ago through redundancy so now I am glad I managed to pay the mortgage off while I could.

I have a roof over my head which gives me some security.

LikeLike

@Ermine – Oh Wow, you can buy a second-hand car with a PCP deal – https://www.theguardian.com/money/2017/feb/25/secondhand-car-bargain-finance-leasing-deals [see the table at the bottom & last paragraph]

I see PCPs for cars as ‘in the spirit of’ endowment mortgages – as far as financial gerrymandering goes ….I hadn’t thought it possible to pull off for second-hand vehicles though, what with the faster deterioration in value.

Given half the country’s drivers at least must now have gravitated onto these deals, surely this has to now be a trigger for mass default the next time financial weather clouds over?

LikeLike